Honor Electronic is included in the CSI 1000 Index, further enhancing its influence in the capital market

Release time: June 09, 2025

Article author: Honor Electronic

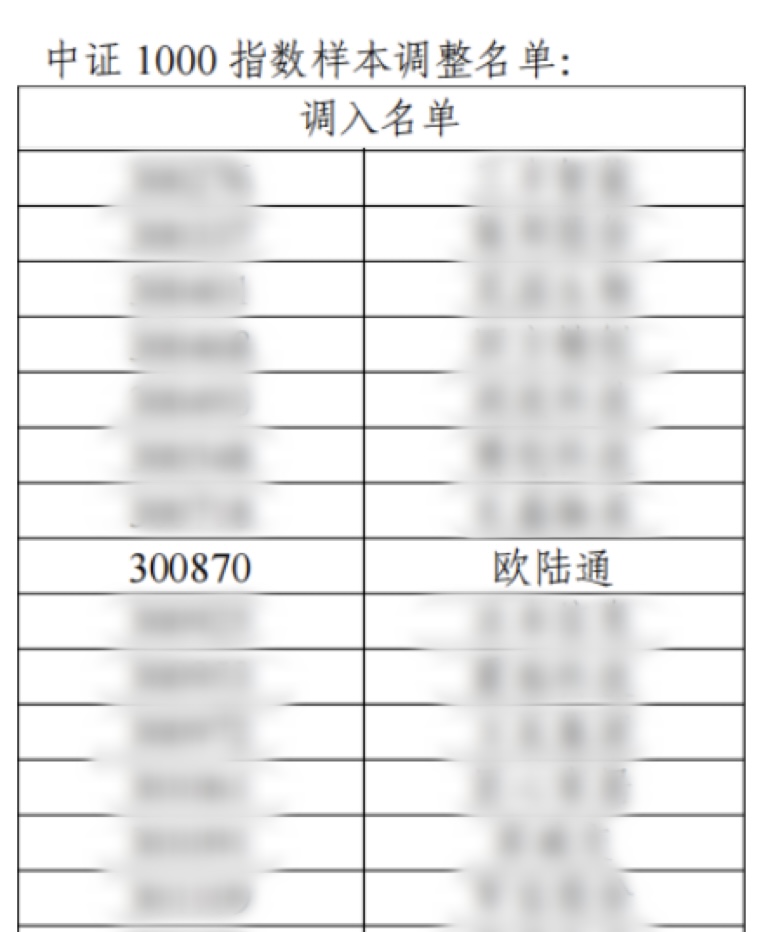

Recently, CSI Index Co., Ltd. released the results of a new round of regular index adjustments. Honor Electronic was selected for the first time in the CSI 1000 Index, and this adjustment takes effect after the market closes on June 13, 2025. After being included in the mainstream index, the Company has the opportunity to receive significant passive capital inflows (with a scale of over 100 billion yuan for CSI 1000 ETF related products) and significantly improve liquidity, while gaining market recognition and attention.

The CSI 1000 Index is compiled and maintained by CSI Index Co., Ltd., representing 1000 securities with relatively small market-cap and good liquidity in the A-share market. It is often regarded as a representative index of "small cap stocks". CSI 1000,CSI 300 (representing the large cap) and CSI 500 (representing the mid cap) form the core index system of the performance of the A-share market at different levels of scale.

The CSI 1000 Index, as the core representative index of small cap A-shares, is re-sorted and screened based on rules every six months. Its constituent stocks have strict criteria and multidimensional requirements,such as liquidity, market cap and compliance, such as daily average market cap and daily trading volume. The selected stocks are:

① an improvement in market influence: becoming a benchmark enterprise with strong liquidity and excellent growth potential among A-share small and medium-sized enterprises;

② Capital attention has risen: entering the mainstream index system, attracting key coverage from passive and active institutional investors;

③ Brand value enhanced: Obtain endorsement from authoritative index institutions and enhance credibility.

This index transfer is an important milestone for the Company's capital market image. The Board will continue to promote the Company's entry into mainstream investment vision through systematic compliance management, continuous strengthening investor relations management and ESG rating enhancement measures. In the future, we will continue to deepen our market value management capabilities and help the Company leverage the capital market to achieve high-quality development.